The big divide:

How the fortunes of the “big six” holding companies diverged in 2023 – and what that means for the industry’s future

In 2023, sizeable fault lines began to appear between the performances of the “big six”.

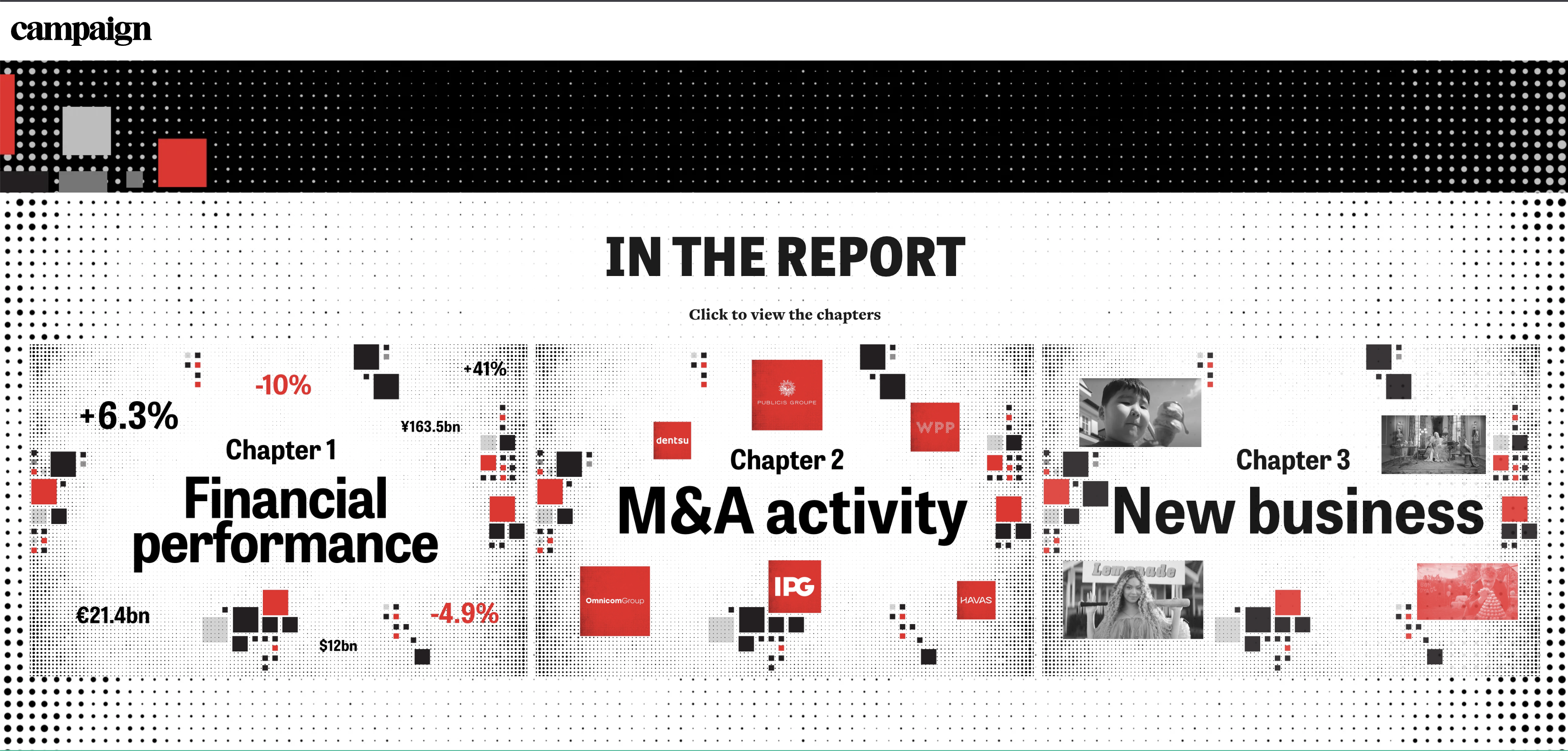

Just take the key measure of organic revenue growth. There was a spread of more than 10% last year between the top performer, Publicis Groupe, which grew 6.3%, and Dentsu, which fell 4.9%.

What's going on? Holding company chiefs are under increased pressure. The past few years have demanded they reorientate their businesses around more data-driven, digitally focused models. But 2023 brought difficult macroeconomic conditions, the arrival of generative AI at a mass scale and client spend reductions, particularly in the tech sector.

In this report, Campaign shows how the “big six” holding companies (Dentsu, Havas, Interpublic, Omnicom, Publicis Groupe and WPP) responded to these challenges, assessing their financial performances, M&A activity and new business prowess across the world.

Find out...

In 2023, Publicis pulled away from its competitors, with the best organic revenue growth, largest profit margin and a whopping 41% increase in share price, while some of its rivals lagged significantly.

As the 2023 Q2 results were announced, Publicis upgraded its annual revenue forecast at the same time as Dentsu, Interpublic and WPP reduced their forecasts, blaming cuts by tech clients and a slowdown in demand for business transformation work.

The world’s biggest ad market was the kingmaker in 2023. The three best performers, Publicis, Havas and Omnicom, all grew in the US, while the three weaker players declined.

Omnicom made the biggest acquisition in its history when it snatched US business Flywheel out of the jaws of an imminent IPO, taking the market by surprise. With Flywheel’s retail capabilities, Omnicom will now prioritise “sales” above “advertising”. Wren says that he believes “I can beat anybody on a pitch” if he can show them not his “personality and promises” but the “tools and capabilities” he now owns.

The volume of M&A deals dropped 29.8% last year and may continue to be “less of a priority”. The difficult economic climate means money is harder and more expensive to borrow, while analysts say shareholders are more risk averse and want their returns now – through larger dividends or share buyback schemes.

Havas Media Group came under fire when it won oil giant Shell’s global media account. It endured “die-in” protests and lost a client. Meanwhile, the B Corp status of its sister agencies are now under review. What does this furore mean for the future of new business?

In 2023, Publicis pulled away from its competitors, with the best organic revenue growth, largest profit margin and a whopping 41% increase in share price, while some of its rivals lagged significantly.

As the 2023 Q2 results were announced, Publicis upgraded its annual revenue forecast at the same time as Dentsu, Interpublic and WPP reduced their forecasts, blaming cuts by tech clients and a slowdown in demand for business transformation work.

The world’s biggest ad market was the kingmaker in 2023. The three best performers, Publicis, Havas and Omnicom, all grew in the US, while the three weaker players declined.

Omnicom made the biggest acquisition in its history when it snatched US business Flywheel out of the jaws of an imminent IPO, taking the market by surprise. With Flywheel’s retail capabilities, Omnicom will now prioritise “sales” above “advertising”. Wren says that he believes “I can beat anybody on a pitch” if he can show them not his “personality and promises” but the “tools and capabilities” he now owns.

The volume of M&A deals dropped 29.8% last year and may continue to be “less of a priority”. The difficult economic climate means money is harder and more expensive to borrow, while analysts say shareholders are more risk averse and want their returns now – through larger dividends or share buyback schemes.

Havas Media Group came under fire when it won oil giant Shell’s global media account. It endured “die-in” protests and lost a client. Meanwhile, the B Corp status of its sister agencies are now under review. What does this furore mean for the future of new business?

To gain access to the complete report and enjoy all of Campaign’s premium content please get in touch to discuss our bespoke packages.

Global intelligence editor Kate Magee

Senior data editor Glauk Mahmutaj

Data journalist Jamie Rossouw

Special report art director Paul Frost

Data visualisation designer Rhea Ramtohul

Data projects manager Carolyn Avery

Production editor Bethany Coombs

The information on this report is correct as of 30 April 2024